You may want to ignore this post if you do not interest in Malaysia rates for Fixed Deposit (FD), Savings, Inflation and Employee Provident Fund (EPF).

If case you have not heard about EPF, EPF is something similar to CPF in Singapore and 401(K) plan in U.S.

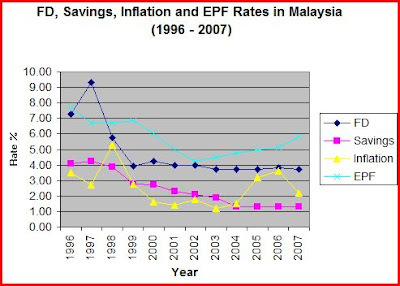

The chart and raw data below shows the FD, savings, inflation and EPF rates in Malaysia from 1996 to 2007.

| Year | FD (%) | Savings (%) | Inflation (%) | EPF (%) |

| 1996 | 7.26 | 4.10 | 3.50 | 7.70 |

| 1997 | 9.33 | 4.23 | 2.70 | 6.70 |

| 1998 | 5.74 | 3.87 | 5.30 | 6.70 |

| 1999 | 3.95 | 2.76 | 2.80 | 6.84 |

| 2000 | 4.24 | 2.72 | 1.60 | 6.00 |

| 2001 | 4.00 | 2.28 | 1.40 | 5.00 |

| 2002 | 4.00 | 2.12 | 1.80 | 4.25 |

| 2003 | 3.70 | 1.86 | 1.20 | 4.50 |

| 2004 | 3.70 | 1.30 | 1.50 | 4.75 |

| 2005 | 3.70 | 1.30 | 3.20 | 5.00 |

| 2006 | 3.80 | 1.30 | 3.60 | 5.15 |

| 2007 | 3.70 | 1.30 | 2.20 | 5.80 |

| Average | 4.76 | 2.43 | 2.57 | 5.70 |

As usual, EPF has the highest interest rate, follow by Fixed Deposit (FD) and savings. Except in 1997 where the FD has higher interest rate than EPF. As you can see from the graph, both EPF and FD outpace the inflation but not in savings. Therefore all my emergency funds are put in FD rather than in savings.

The tricky part of this data is all these rates here are accurate except for the inflation rate. As what Michael said in my post previous - How can I get most updated inflation rate:

"National reported inflation rate is for "Everybody", and I am NOT Everybody."The inflation rate shown here is national inflation rate and it is definitely not accurate for you because everyone of us have different inflation rate depending on your spending. That's why you see a lot of people have 10% raise but they don't' save 10% more. Why? This is probably their personal inflation rate increases too. Once you have your personal inflation rate, I bet the FD won't be able to outpace the inflation rate as like the data shown above.

Hope this data is something useful to you. You can also look at inflation rate in other countries here if you're interested.

[Updated: 27 Feb 2011]

Apparently the data in this article is only up to 2007 and I will use the following post to keep track of the latest interest rates in Malaysia. Please go to that link:

22 Comments:

may be can add stock index to this chart too, that would make it more interesting .....

Wow...interesting, thanks for the information !!!

That's terrible!Before I could earn the EPF interest quite alot.Saving my money in FD and savings has no difference at all.and What about the mortgage interest?Increasing or dreasing huh?

Mortgage rate is lower compared to a few years ago. The difference is about 2%. By refinancing a 30-year mortgage may save as much as 30k of interest for every 100k of mortgage! I'm going to write something about mortgage refinancing when I have time.

I agree that the official announcement of the inflation rate is not the inflation that we are experiencing.... the basket of products the government use, and the place where they were bought, probably have cheaper prices. The government should come out with living index for different cities or states in Malaysia. One single rate is not enough to tell the whole picture. With the living index, we can tell which place is expensive and employers can use that to adjust salary accordingly.

Btw, check out my recent post on risk management in investment.

Champdog,

I used to remember EPF rate was 13% back in the old day, late 80's, or I was in my senior moment.

Find an asset class that inflate faster than inflation.

Gold and silver is one of such asset class the last 10 years.

When I first move to the US 8 years ago, gasoline was less than $1.50 a gallon, now it is $3.1 a gallon. And gold was $220 an oz , now gold is near $1000 an oz. (All gold stocks which are components of the gold index $HUI have gone beyond inflation rate : I bought AEM at $5 and now it is $70, GG was $4 and now it is $42, SSRI was $3.5 and now it is $40 and others which I am too tired to write now).

At hyperinflation era, saving is useless unless you can find investment that move faster than inflation rate.

Not bragging here but thought I pass on my insight to you young people. Might be it is worth looking for an asset class that is a good inflation hedge tool.

@Michael

Good idea! I’m not sure if I have data. :D Anyone?

@Mee Moe

You’re welcome. But will this information useful to you since you’re in U.S? I just wonder only. It will be great if we have the U.S data too.

@Sweetiepie

You’re right. Usually we don’t treat FD and Savings as investment. For me, I usually treat them as “Savings”. For emergency cash, I put it into FD. I don’t t have the exact data too. I think usually “Mortgage Rate” follows the economy. If the economy is bad, the loan interest is low and when it is good, the interest is higher. Ya, it is increasing because the economy is getting better. This is how I see it.

@Jose

Refinancing may not be a good choice for everyone. I have seen bank to offer you refinancing package provide that you borrow more. They’re in fact encourage you borrow more and therefore you pay more (total amount) but with a lower interest. My 2 cents, don’t refinance just for the sake of lower interest. Think carefully before you decide, they usually have pros and cons.

Living index for different cities sounds like a good idea. Why we don’t even have that? I guess it is just too troublesome? I think this is the closest to as what Michael mentioned before about the “Supermarket Rate”. We use groceries that we buy from supermarket as the benchmark. Probably this is the closest to “Living index” inflation?

Yes, it also more accurate used by employers for salary adjustment. Well, I guess it is not going to happen until I retire.

@Kayatan

I have the data too. In late 80’s the EPF is 8% and the FD is 5.4%. In fact in 1981, the FD rate (11%) is higher than the EFP (8%).

I totally agree with your comments on finding an asset class that grow faster than inflation. However, I’m not sure about Gold and Silver. No offense on it, what you see is the past and it doesn’t guarantee the future. In what justifications that you are so sure that Gold and Silver is the best investment in future? For instance, a new gold or silver mine has been found, isn’t that the gold or silver price is going to drop? Of course, they’re other factors as well. I’m just trying to learn here.

Champdog,

What you said not good is the bank officer trying to ask you to borrow more at lower interest when refinancing. But refinancing at a lower interest rate is a smart strategy as you do not need to pay that extra interest and can use it for other purpose such as investment or to meet other commitments. If you keep paying the same installment amount after refinancing, you will be able to settle your home mortgage in a shorter duration.

When you refinance your home mortgage, you have the option to refinance the outstanding loan amount, or refinance more than that to have extra cash(provided your home value has increase). It is your choice and you do not have to listen to the officer. As long as you understand the cost, and why you need to refinance and how much you can save through the refinancing, it will be a good thing to do.

Of course, refinancing home loan just for the sake of getting more money to spend on unnecessary purchases are not encouraged. This will only put you into more debt rather than reducing you debt.

nice info.

i think in this kind of market, its better to keep the money in FD or keep them in savings for rainy days. no point putting in stock or funds.

@Jose

I totally agree with you that refinancing loan for the sake of getting more money to spend is definitely not smart at all. But you know, they’re people doing that and they’re not few. They’re quite many. Refinancing always comes with Term & Condition that may not be suitable for everyone. Like for my case, my outstanding loan is RM70K, any refinancing package good for me (with lower interest and not increase the loan amount)?

@Alvin

You mean the recent bad market condition, it is better to keep in FD or saving? But it is really hard to say. Some people said we should invest even more when the market is bad, so the gain is higher when the market turns good later. Putting your money in the FD or saving have the risk of the inflation which eventually makes your money’s value becomes lower. Don’t you think so?

FD and EPF interest rate are going down every year, not worth to put there.

better invest in unit trust or may be put in ASM, which provide around 7% to 10%

icalvyn, I agree with you but for EPF I think it is still okay. I don't really withdraw it for unit trust investment.

EPF at least is 'tankong' by the government, unit trust is not.

When US goes down, all the rest will go down and unit trust will bankrupt big times, at least for EPF unless Malaysia government goes bankrupt which is not likely with all the black oil underneath the tanah.

But unit trust ? who 'tankong' ?

When US economic melt down, all dunia unit trust, trust units will go down big times. The last few years, unit trust, trust unit are peggy back on US good times.

I still think EPF is one of the best for Malaysian citizen. Why on earth would other country employers contribute 10% of your pay to put into your retirement, 'tanku' also tak ada.

I definitely agree with you that. That’s why I haven’t withdrawn my money form EPF to invest in Unit Trust. Good thing about this is because recently they offer some service charge discount for EPF withdrawal for the purpose of unit trust investment

Strictly speaking, I think Unit Trust Company is still protected under “Bank Negara”. I don’t think it is that easy to go bankrupt. But bad performance in their funds could happen.

I prefer to withdraw my EPF first account money in any unit trust company because i believe it is worth to take the risk rather than keep it in EPF that only provides dividen 5~6% yearly or even lower. Inflation will eaten up all the dividen earned. I am willing to take the risk lose all my EPF money but at least it is a calculated risk by those professional in the field. Now I am 33 years old, I don't even know whether I can live till age 55 and spend all my hard earned money.

It could be a right choice now since the performance for unit trusts recently are not that good due to the U.S recession. Most of the funds have a very low price now. I may now want to consider withdraw my EPF. It is a right moment if you think about it.

Really great thanks for sharing this information. :)

Anyone has a mortgage applied > 5 years ago definitely worth refinancing, whether or not for extra cash.

A Ringgit Saved is more than a Ringgit earned (income tax effect).

In late 90, FD rate > EPF because of BLR increased to double digits. Highly unlikely will happen again in our lifetime.

Saving in EPF gives consistently higher return than FD, an option worth looking into especially now you can OPT to self contribute via internet banking. If you wish to know more, visit my blog for more info.

The bottom line is still you make your own calculation see whether it is really worth. Of course, the longer you need to pay all your learn, the more you want to consider to refinance.

I don't think that will happen too for FD rate > EPF. EPF at least is very safe. I agree one should put their money there and minimize the withdrawal.

In "this" market and any other "kind" of market I will continue to take the Dave Ramsey approach to investing and that is contributing 25% of money allocated to investing into each of 4 mutual funds (growth, growth & income, international, aggressive growth).

vy good infos... thanks.... but how bout the data from 2008 til current? can u provide the data as well? thank u.

Apparently you missed the last past of this post. :) Here you go the latest data:

http://financialindependent.blogspot.com/2011/02/latest-fd-epf-inflation-blr-and-saving.html

I have included the BLR trend too. :)

In Present Global economy situation its better to choose for debt instrument for investing.Markets are very volatile investors are worried about where to keep their money.IN this scenario, investing in FD is better option.

Post a Comment